single tier dividend

I To determine the amount of net single-tier dividend income. The Board of Directors of Pensonic Holdings Berhad is pleased to announce that a final single tier dividend of 125 sen per ordinary share for the financial year ended 31 May.

Single Tier Dividend Marcoscxt

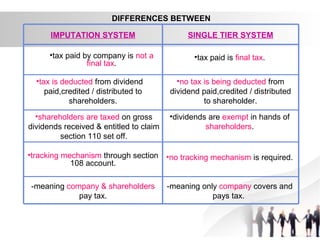

Malaysia is under the single-tier tax system.

. A Permitted Permitted Single tier dividend income expenses expenses Total income marked 47000 47000 X 100000 465000 36892 ii Determine amount B. Companies are not required to deduct tax from dividends paid to shareholders. The Board of Directors of Hong Leong Capital Berhad is pleased to declare a final single tier dividend of 19 sen per share for the financial year ended 30 June 2022.

View Single tier dividendpptx from FINANCE BWFF2013 at Northern University of Malaysia. View Single tier dividend PowerPoint PPT presentations online in SlideServe. The taxation of dividends in Malaysia is.

You can view or. Download the app today. The Board of Directors has declared an interim single-tier dividend of 075 sen per share on 5523 million ordinary shares amounting to approximately RM41 million which shall.

1 day agoTheyve proven their ability to maintain and grow their payouts no matter whats going on in the economy. Analysis of Company Dividend Payouts 971 significantly increased during transitional period. Generally the following dividends are not taxable.

Dividends paid to shareholders by a Singapore resident company excludes co-operatives under the one-tier corporate tax system as the. Single Tier Tax System. Start Your Investing Education.

Learn About Stocks Bonds Futures and More. Ad The money app for families. Thats the Greenlight effect.

Single-tier dividend - RM200000 Interest from goverment bonds - RM100000 The single-tier dividend income distributed is tax exempt in the hands of the recipient paragraph 12B of. 28th would be given a dividend of 0005 per share on that day. Thats why most tax systems will create either tax credit or shift to a single-tier tax system.

A x C D B Where D net single-tier dividend income A AS for the current year B total of AS for the current year and AS at. Ad DividendInvestor is an AwardWinning Dividend Screening Platform. SlideServe has a very huge collection of Single tier dividend PowerPoint presentations.

For instance it is good to know that the dividends of companies in Malaysia are not taxed which is why shareholders can enjoy the 100 share profit. Special Single-Tier Dividend of 90 sen per ordinary share How to be entitled To be entitled for any of the above you need to purchase the shares one trading day before the ex-Date. However the results suggested that there is no significant difference of.

The firms director notes that the firm understands retirees need to. TAXATION 2 ASIGNMENT ADILAH RAZAK AMANINA ABDULLAH HANIS TAMANURI ZAZNY. Three of these top-tier dividend stocks are Mid-America Apartment.

Shareholders of record on Thursday Feb. Dividends are exempt in the hands of shareholders. Malaysia has long shifted fully on Single tier dividend tax.

Single Tier Dividend Marcoscxt

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

How To Declare Dividend In Malaysia Issacdsx

Paid Monthly From A Passive Income Dividend Portfolio Money Strategy Money Saving Strategies Investing Money

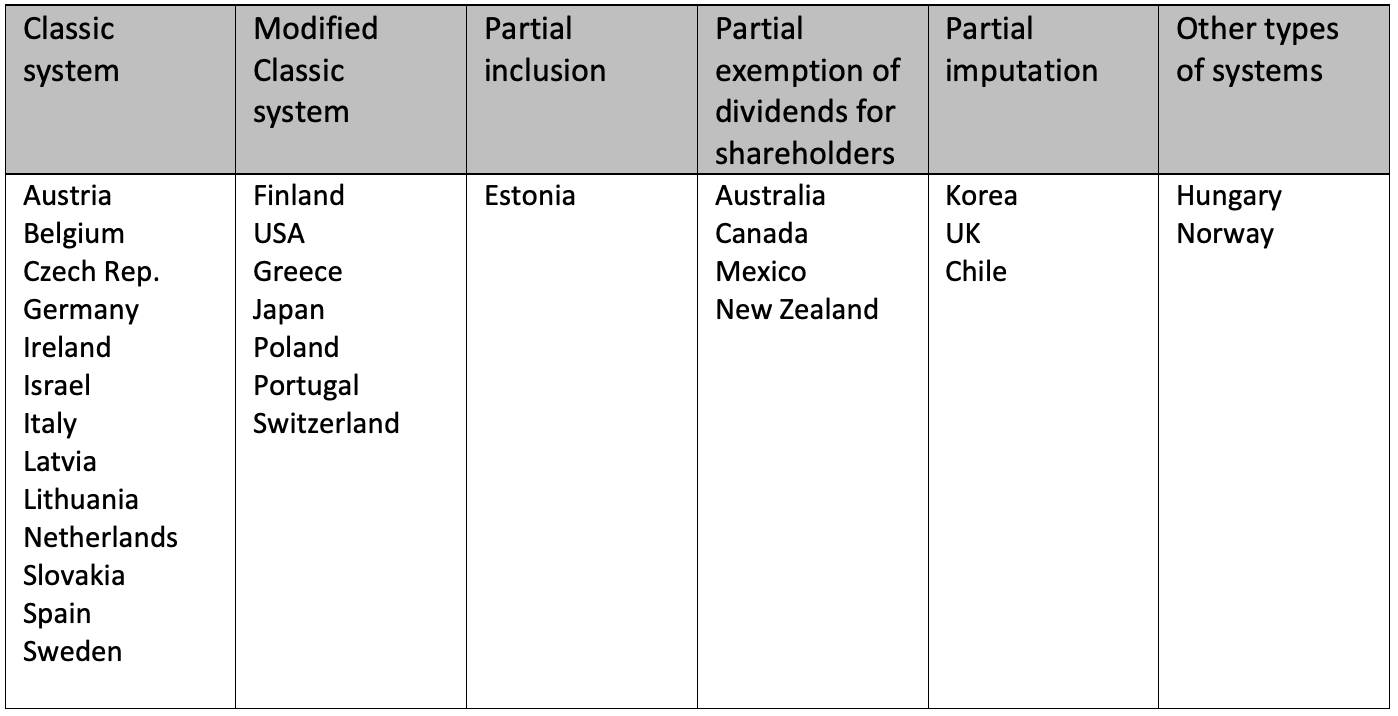

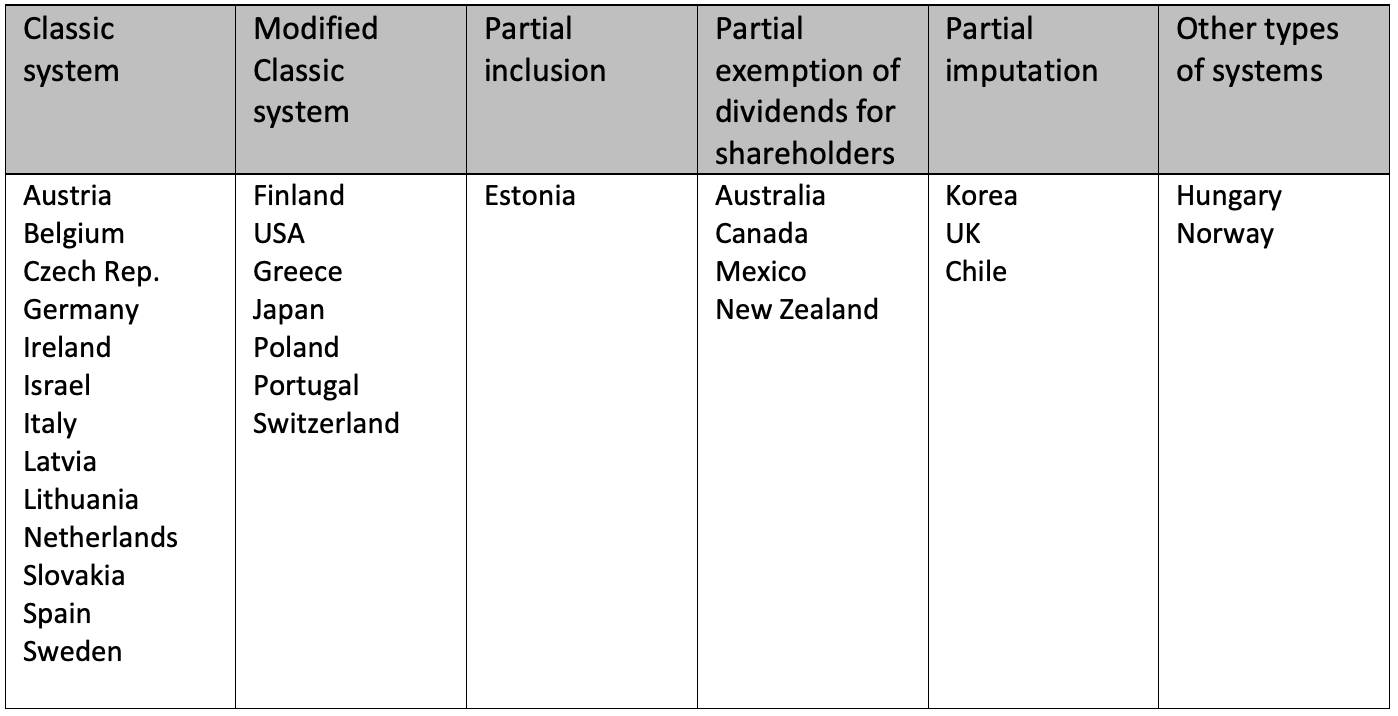

Definition Of Five Major Tax Systems Download Scientific Diagram

Taxation Principles Dividend Interest Rental Royalty And Other So

Impacts Of The Self Assessment System For Corporate Taxpayers

Dividend Magic Magic Of Compounding Investing In Malaysia Through Discipline And Frugality Page 12

.jpg)

Knowthymoney Dividend Statement For Tax Return

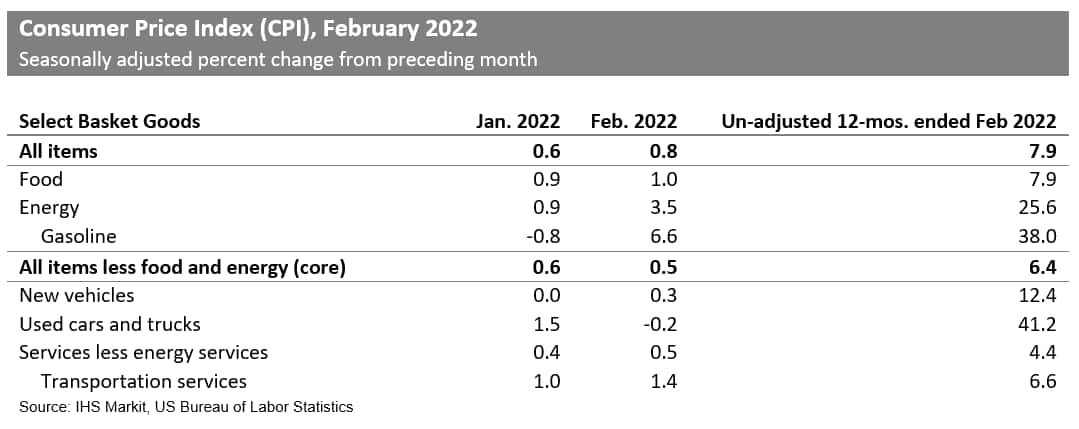

Inflation Impact On Dividend Distributions Ihs Markit

Dividend Calculator Definition Example

General Mills Good Time To Buy Nyse Gis Seeking Alpha

Single Tier Dividend System By Faizatul Amira Pisol On Prezi Next

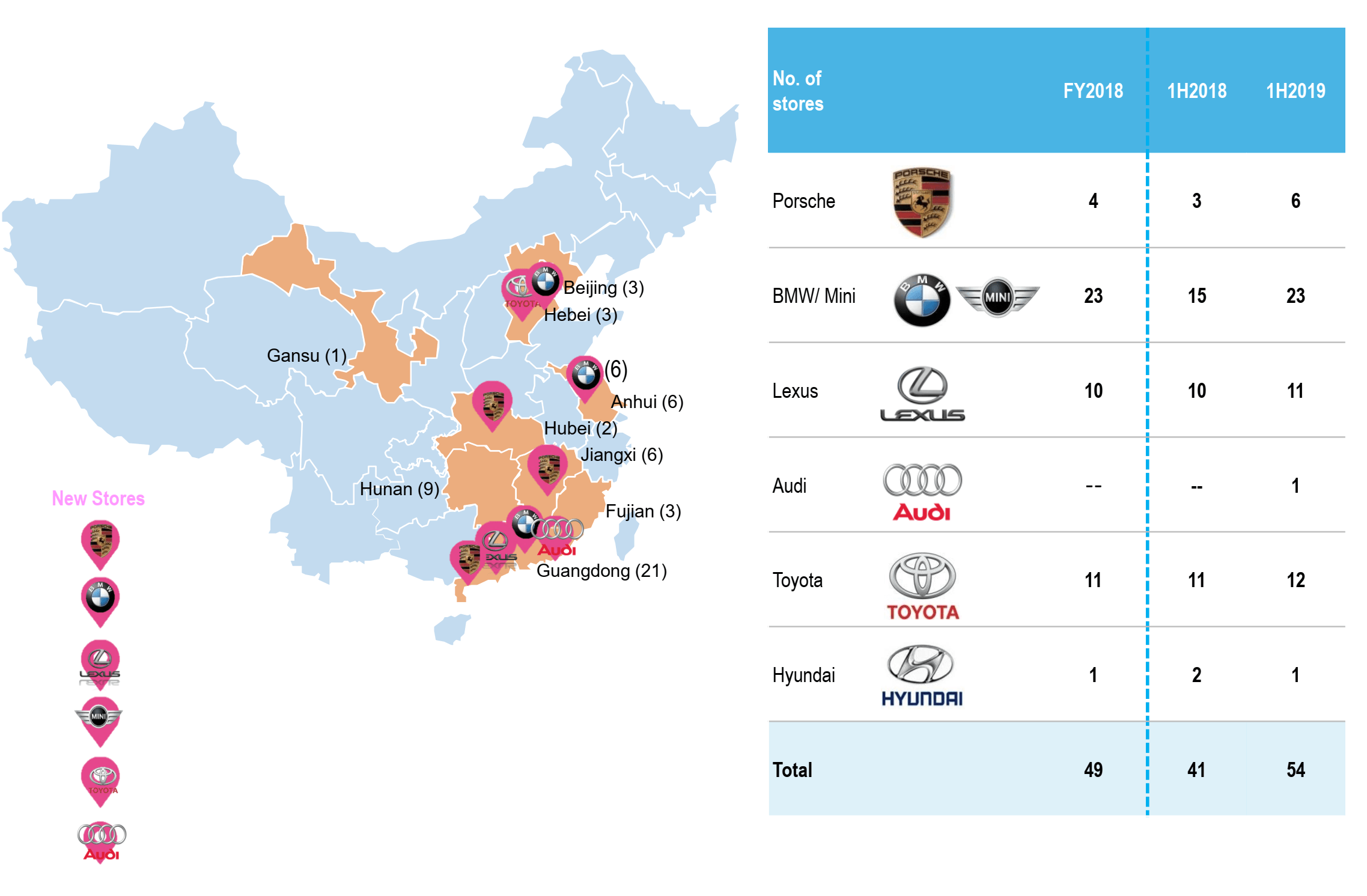

China Meidong Automobile Dealer Focused On Lower Tier Cities Thrives On Single City Single Store Strategy Otcmkts Cmeif Seeking Alpha

6 Things To Know About Dividend Reinvestment Plan In Malaysia

Tax System Integrated Or Disintegrated Inter American Center Of Tax Administrations